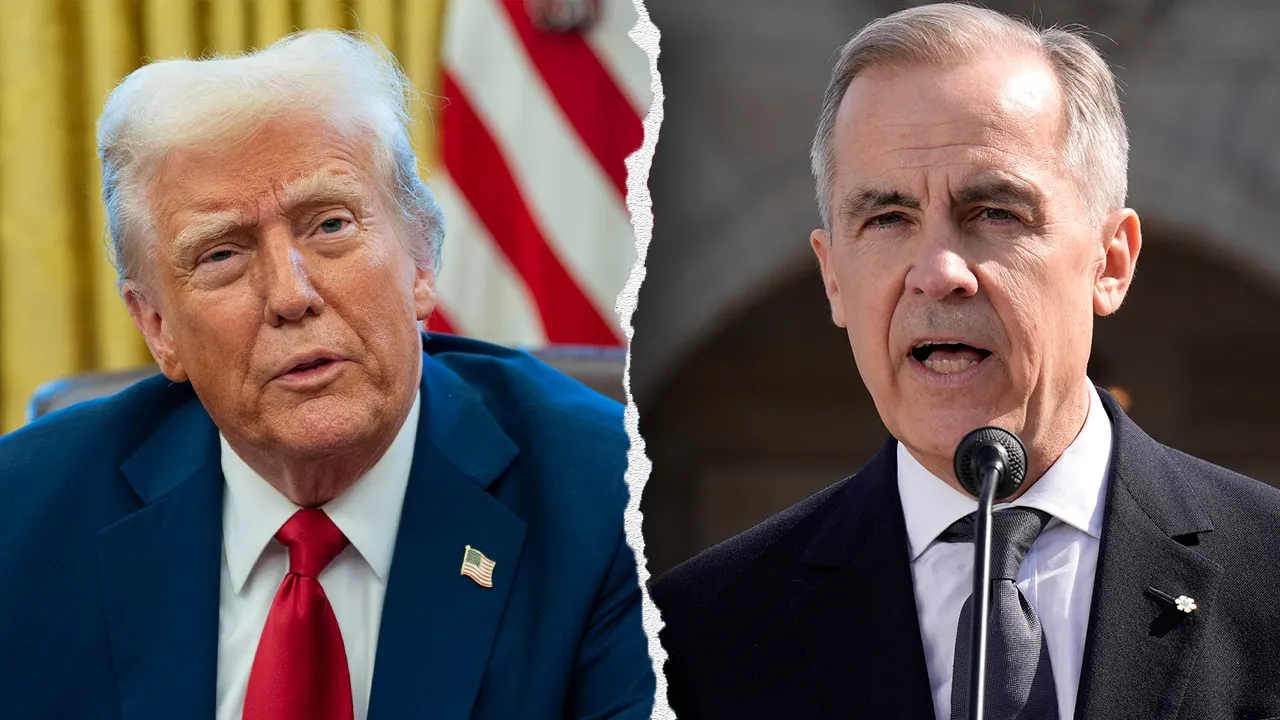

A seismic shift in the foundational U.S.-Canada economic relationship is now underway, triggered by aggressive trade rhetoric from Washington and a historic strategic pivot from Ottawa. This is not a mere diplomatic spat but the acceleration of a structural realignment with profound, lasting consequences for American jobs, prices, and economic stability.

Former President Donald Trump’s public threats of major new trade barriers against Canada, framed as protecting U.S. industries, have acted as a catalyst. In response, Canadian political and economic leaders are openly discussing unprecedented countermeasures to dramatically reduce their nation’s dependence on the United States.

For generations, the two economies have been intricately fused. Supply chains for automobiles, energy, agriculture, and countless goods flow seamlessly across the world’s longest undefended border. This integration underpins millions of jobs and stable consumer prices on both sides.

That deep integration is now the vector for potential shock. When a partner of Canada’s scale and proximity begins seriously discussing redirecting trade and investment, it rings a structural warning bell. This signals a move from stable interdependence to managed risk diversification.

The immediate corporate reaction is already unfolding. U.S. manufacturers reliant on Canadian inputs are contingency planning. Investors are reassessing cross-border holdings. This volatility occurs not when policies are implemented, but when their mere possibility shatters long-held expectations of predictability.

Canada’s response is a rational calculation, not defiance. Faced with an unpredictable primary trading partner, diversifying through new global partnerships and supply routes is a logical act of economic self-preservation. This strategic insulation aims to protect the Canadian economy from volatility in American politics.

The cost to the United States will be measured in billions. As Canada reduces its reliance, American industries lose guaranteed markets, reliable suppliers, and significant leverage. Corporations facing lost revenue will inevitably cut costs, relocate production, and reduce labor.

Workers and communities will absorb the initial impact. Layoffs, reduced hours, and plant downsizing in interconnected industries will be the first visible symptoms. These consequences manifest in paychecks and local economies long before official trade data reflects the change.

This moment exposes the fragility of economic architecture built on assumed permanence. The system functions smoothly only when powerful actors exercise restraint. Pursuit of short-term political advantage injects volatility that is ultimately paid for by households, not policymakers.

The erosion of trust is a critical, intangible loss. Economies operate on expectations and predictable behavior. When that trust breaks, businesses hesitate on long-term investments, governments reconsider joint projects, and the foundation for stable growth becomes shaky.

Behind the scenes, a million small business decisions are reshaping the relationship. Companies are quietly seeking alternative suppliers and export markets. This steady, quiet recalibration of risk is often irreversible, permanently loosening economic bonds.

Canada’s move is being closely watched by other U.S. allies globally. Unpredictability with a closest partner signals unreliability, weakening America’s negotiating power and encouraging other nations to also diversify away from U.S.-centric systems.

The ironic outcome of aggressive trade posturing is often self-weakening. Asserting dominance by undermining stability prompts partners to insulate themselves, thereby diminishing the initiator’s influence. Leadership in the global economy depends on consistency now in question.

This shift has been building for years. Each prior trade dispute prompted quiet risk reassessments and groundwork for new alliances abroad. The current rhetoric has simply accelerated this existing trend into public view.

The true beneficiaries of this volatility are mobile capital and multinational corporations capable of restructuring globally. The true costs will be borne by workers, families, and local communities, lacking the mobility to adapt when regional industries falter.

Trade conflicts are often framed as protecting domestic labor. In practice, they create cover for corporate restructuring that further disadvantages workers, who become the buffer for shocks emanating from policy decisions they did not make.

The so-called “Canadian Revolution” is not an act of rebellion but a strategic transition. It is the point where accumulated recalculations shift the economic center of gravity, challenging the United States’ presumed permanent dominance in North American trade.

The long-term consequence is a slow erosion of U.S. economic privilege. Once supply chains relocate and markets diversify, they rarely return. The stability once taken for granted is being deliberately, and perhaps permanently, unwound by a key partner seeking security in a newly volatile landscape.